26+ assuming parents mortgage

When you close on the home purchase your dads lender will get the 170k to close out his current mortgage and youll get the. Web Taking over a parents mortgage requires that the loan is actually assumable and that theres not a due-on-sale clause.

77 Golden Eagle Dr Boise Id 83716 Zillow

Web Home ownership is one of the great cornerstones of the American dream.

. Web Therefore if you apply for a mortgage jointly with your parents and they are aged 70 a lender might reject the application on a 25-year term if their policy does not permit. Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. Web Here are some of the lenders requirements you must meet to qualify for the assumption.

Web I want to buy the mortgage from my dad I understand that dealing with family is not advisable but I am aware of the risks. But what happens to the mortgage you have on your home after you pass away. Updated FHA Loan Requirements for 2023.

Your parents may agree to sell to you at a more reasonable price and waive any. As the named borrower the heir. The lender will run an eligibility check on the new borrower of the loan.

The interest rate and payment period stay the same. Choose the Type of Property Provide Your Details with Our Step-by-Step Instructions. Select Popular Legal Forms Packages of Any Category.

Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. Web When starting the assumption process the lender may ask you to fill out an application and submit forms such as past pay stubs W-2 forms and bank statements. Lets say the original borrower took out a mortgage in the amount of 400000 and has since paid it down to 320000.

For example your deceased parent may have left you a mortgaged. Check Your Official Eligibility Today. Both parties can save a lot of money.

If you are looking to take over house payments from a relative you need to have all of your ducks in a row. 1500 Irving Hill Dr LOT 26 Knightdale NC 27545. Taking Over a Mortgage for a Family Member.

Web 735 Ishani Ridge Ct Pahrump NV 89048-4102 is a single-family home listed for-sale at 354900. Ad Take the First Step Towards Your Dream Home See If You Qualify. View more property details sales history and Zestimate data on Zillow.

Choosing to refinance may be a good. Lenders that allow a buyer to take over the payments on a. Web A 1982 federal law makes it easy for relatives inheriting a mortgaged home to assume its mortgage as well.

An aging parent lives in a house with little equity plans to move into assisted living and wants to help a. All Major Categories Covered. Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online.

According to our mortgage calculator which you can use to model your own scenario monthly. Home is a 3 bed 30 bath property. Web Assuming a mortgage is a process by which you take over the payments on an existing loan rather than secure your own financing to purchase the house.

Agent finder Open Agent finder sub-menu. Web If youre offered an assumable mortgage at 26 youd likely be over the moon. Ad Use LawDepots Mortgage Agreement to Secure Repayment of the Loan.

Web If the mortgage is an Adjustable Rate Mortgage ARM then your payments will change as the interest rate changes. There are exceptions however for inherited homes. Web Transfer of mortgage is only possible if your mortgage is an assumable or transferrable mortgage.

Web Your mortgage payment should be about 30 35 of the total monthly household income. Web Here are a couple situations where mortgage assumption might work. Web If youve assumed the mortgage of a loved one who has passed you have options for handling their home loan including refinancing.

Web You can apply for a mortgage loan for 170k. Web The rule does not require the creditor to determine the heirs ability to repay the mortgage before formally recognizing the heir as the borrower. You must agree to take over all the liabilities associated with the mortgage.

You have a payment due each month. MLS ID 2499692 Mungo Homes Of Nc. Web Theres another big benefit to buying your parents home.

A mortgage payment that takes up approximately 33 of monthly household. My dad bought the house with an FHA loan of. Web A 15-year term means you have 15 years to pay off your mortgage and a 30-year term means you have 30 years.

Web An assumable mortgage is a home loan that can be transferred from the original borrower to the next homeowner. Web Traditionally when someone assumes a mortgage the second party pays off the original borrowers equity in the form of a cash down payment.

Bike Check Bruni S Shiny Surprise Bergamont S 26 Wheeled Prototype Dh World Championships Vallnord 2015 Pinkbike

How To Take Over A Parent S Mortgage Sapling

Is It A Good Idea To Pay My Parents Mortgage Quora

Getting A Mortgage After Bankruptcy And Foreclosure

Taking Over Your Parents Mortgage Here Are 3 Tips

Open Esds

How To Assume A Mortgage 10 Steps With Pictures Wikihow

Will General Electric S Business Forecast Be Impacted By Supply Chain Concerns

Can You Assume A House Loan After A Parent Dies

Can You Assume A House Loan After A Parent Dies

1020 Miracle Ln Mccall Id 83638 Zillow

Buying A Home There Are Ways To Bring Down Your Mortgage Payments Inmaricopa

Pdf Grandparents In Multigenerational Households The Case Of Portugal

Can You Assume A House Loan After A Parent Dies

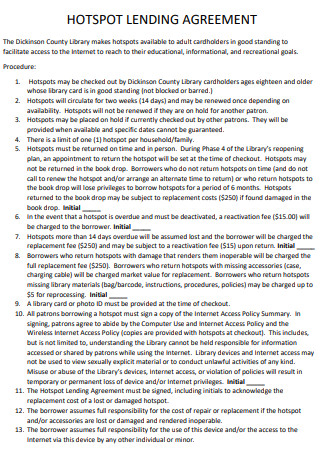

26 Sample Lending Agreement In Pdf

Boris Johnson Wants Multi Generational Mortgages Of Up To 50 Years The Independent

Fifty Year Mortgages That You Pass On To Your Children The New Plan To Boost Home Ownership