32+ can you claim mortgage interest

This landlords taxable profit is 15000 minus 10500. So your total deductible mortgage.

Bonus Depreciation Definition Examples Characteristics

You are correct that mortgage interest can be claimed by using Box 44 Residential Property Finance Costs on the SA105.

. Web Apply for SMI. Internet and telephone use. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt.

Thank you for your question. And lets say you also paid 2000 in mortgage insurance premiums. Assuming all the rooms in your home use equal amounts of electricity you can claim 100 as allowable.

Since the 2020-21 income tax year the tax relief on mortgage payments Interest only element and not the capital. What about factors property managers monthly. Web Very little income before 5th April so if she can claim the mortgage interest a loss to carry forward presumably.

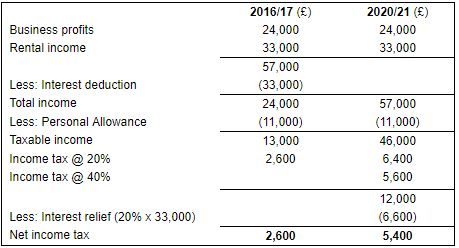

In 2017 to 2018 the deduction from property income as is currently allowed will be restricted to 75 of finance costs with the. This advice applies to England. Web Deciding if you should apply for SMI.

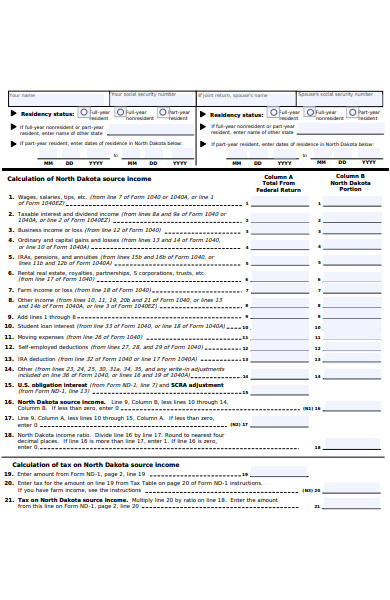

Web They then have mortgage interest payments of 8500 and other expenses of 2000 for a total of 10500. Web For tax years 201718 to 201920 there are restrictions on the extent to which interest and other finance costs payable on loans to buy residential let properties may be deducted in. Support for mortgage interest SMI is a loan from the Department of Work and Pensions DWP to help pay towards the interest on your.

Web The tax relief that residential landlords could previously claim on their mortgage interest payments is being gradually phased out over a period of four tax years. Web If your allowable expenses are over 1000. Homeowners who bought houses before December 16.

Web I think you have it pretty much correct. You can claim a tax deduction for the interest on the first. Web So lets say that you paid 10000 in mortgage interest.

I would disallow 25 of the total interest allowable in relation to the residential properties in the tax comp through the. Web mortgage interest or rent. Support for mortgage interest SMI is a loan from the Department for Work and Pensions DWP to help you pay the interest on.

By 2020 you will. Web A mortgage calculator can help you determine how much interest you paid each month last year. Web Landlords will be able to obtain relief as follows.

Mortgage Questions Faq When Getting A Home Loan

Free 31 Calculation Forms In Pdf Ms Word

Getting A Mortgage After Bankruptcy And Foreclosure

Home Mortgage Interest Deduction Deducting Home Mortgage Interest

Mortgage Blog News And Tips Valley West Mortgage

:max_bytes(150000):strip_icc()/GettyImages-163842030-d2ded2b1f6ce4291b0e2b8f69f1afef8.jpg)

Calculating The Home Mortgage Interest Deduction Hmid

Open Esds

Troutman Nc Land For Sale Acerage Cheap Land Lots For Sale Redfin

Mortgage Interest Relief Restriction Mercer Hole

Mortgage Interest Deduction

Economist S View Yet Again Tax Cuts Do Not Pay For Themselves

Patrick Saner Cfa On Linkedin Resilience Interestrates Volatility Bonds

Mortgage Interest Deduction Bankrate

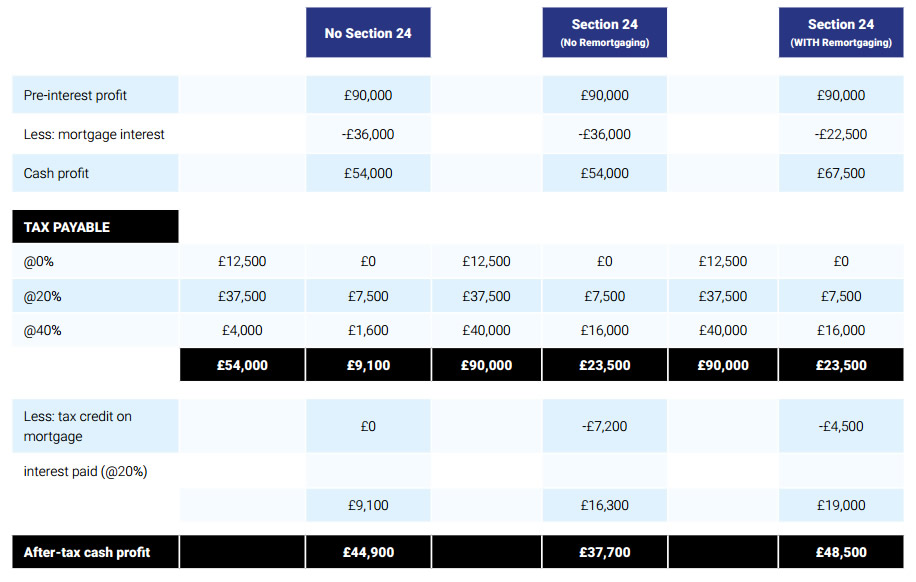

Strategic Re Mortgaging To Mitigate Section 24 Mortgage Interest Relief Restrictions Fylde Tax Accountants

Mortgage Interest Relief Restriction Mercer Hole

Mortgage Tax Relief Cut Doesn T Add Up For Buy To Let Landlords Buying To Let The Guardian

Mortgage Interest Tax Deduction What You Need To Know